EB-5 Investor Visa Questions from Attorneys in San Antonio, TX

EB-5 Direct Investments

The EB-5 program is designed to provide U.S. immigration status to foreign investors and their families. The investors are required to place capital into a business project that creates new jobs for U.S. workers. This paper will concentrate in the following areas:

- What are EB-5 Direct Investments and When are They Used?

- EB-5 Investment Timeline

- Source of Fund Counseling and Project Due Diligence and Selection

- Direct Investment Case vs. a Pooled Investment Case

- The I-526 Petition: Nuts and Bolts

- Immigrant Visa Card Processing and Adjustment of Status Application

- I-829 Application Process

- Citizenship Application Process

- Exit Options and Capital Return

What are EB-5 Direct Investments and When are They Used?

The EB-5 Immigrant Investor Program was created by Congress in 1990 as an economy stimulating program through both foreign investment and job creation.

If the investor is successful in meeting the immigration requirements, the investor is granted lawful permanent residence (aka LPR or green card) including the investor’s spouse and children. If the investment is also successful on the business side, the investor will receive a return of the investment.

This paper primarily involves the EB-5 direct investment model (or stand-alone program) where the foreign investor makes capital investment directly into a new commercial enterprise (NCE). The NCE may then create the jobs by becoming a job creating entity (JCE). In the alternative, another JCE may be formed where money is invested from the NCE. The direct investment also includes a pooled model where more than one investor is involved. The direct model lends itself to smaller operational businesses such as restaurants, franchises, small manufacturing plants, grocery stores etc.

In contrast to the direct investment model is the Regional Center EB-5 program. While not the focus of this paper, the Regional Center is also a pooled model where a number of foreign investors place funds into an NCE. However, instead of stand-alone, the project is organized and associated with a Regional Center. The Regional Centers are typically involved in larger projects often associated with construction.

The primary agency dealing with the EB-5 process is the United States Citizenship and Immigration Services (USCIS). The Department of State is also involved in processing visa petitions for investors who are not in the United States. For a major program, it is somewhat surprising how little legal guidance exists for the direct EB-5 program.

- INA Section 203(b)(5)/8 U.S.C. 1153(b)(5)

- INA Section 216(A)/ 8 U.S.C. 1186(b)

- 8 C.F.R. 204.6 and 216

- USCIS Policy Manual- Vol. VI-Part G – Investors-Chapt. 2

- AAO precedent decisions: Matter of Izummi, 22 I&N Dec. 169 (1998); Matter of Ho, 22 I&N Dec. 206 (1998); Matter of Hsiung, 22 I&N Dec. 201 (1998); and Matter of Soffici, 22 I&N Dec. 158 (1998)

- Stakeholder meetings and informal best practices

The major requirements for the EB-5 Immigrant Investor Program are:

- a capital investment that is “at risk” into new commercial enterprise (NCE);

- in the minimum amount of $500,000 or $1M;

- with the creation of at least ten full-time permanent U.S. jobs;

- from lawfully obtained funds; and

- the investor maintaining a management role.

Capital investment that is “at risk” into a new commercial enterprise (NCE)

A capital investment means an equity investment, rather than a loan, to the new commercial enterprise. Naturally “capital” means cash, but can also mean equipment, inventory and other investment. The investment must be made directly into the new enterprise. At the time that the initial petition is filed with USCIS, the investor is required to show that the funds have been invested or the investment is actively in the process of being made.

The money is required to be “at risk.” This means with a chance of gain or loss. The return of the investment cannot be guaranteed. Recent USCIS guidance states that “at risk” requires that the business activity must have actually started and the investment must be in the job creating entity (JCE) of the project.

The investment must be made into a new commercial enterprise (NCE). An existing business may be acquired if it was established on or before November 29, 1990 and it will be reorganized into a new commercial enterprise or expanded by 40% in net worth or number of employees. An existing troubled business that has been in existence for 2 years and incurred a net loss of at least 20% prior to the investor’s petition can also be acquired.

The minimum investment of $500,000 or $1M

The foreign investor is required to make a minimum investment of $1M. An investment in the amount of $500,000 is satisfactory if the investment is made in a Targeted Employment Area (TEA). A TEA is normally considered a rural area or one with 150% of the national unemployment rate. An area must be shown to qualify as a TEA with the investor’s initial petition. Often the designation of TEA will be made by state agencies. In addition, affluent areas can be combined with less affluent areas to create a TEA.

Creation of at least 10 full-time permanent U.S. jobs

The jobs that are required to be created in an EB-5 direct investment are 10 full-time (35+ hours), permanent regular jobs needed for the business for each investor. These are W-2 type jobs. If the job was created but there was a legitimate failure of the investment, then the job will still count. The workers are required to be U.S. citizens or have other lawful status. The investor, spouse and children do not count. In the case of a troubled business, the investor will need to show that 10 jobs were preserved or created. In contrast, the Regional Center project is able to count direct jobs but also imputed jobs that are calculated by economic modeling.

Investments from lawfully obtained funds

The investor must show that the investment was obtained through lawful means. The funds cannot be directly or indirectly derived from criminal activity.

The investor maintains a management role

The investor must also maintain a management role in the business. While Direct EB-5 investors may choose to actively manage the day-to day business, this requirement can also be met as an officer or in a more limited role such as a limited partner or similar policy formulation role.

EB-5 Investment Timeline

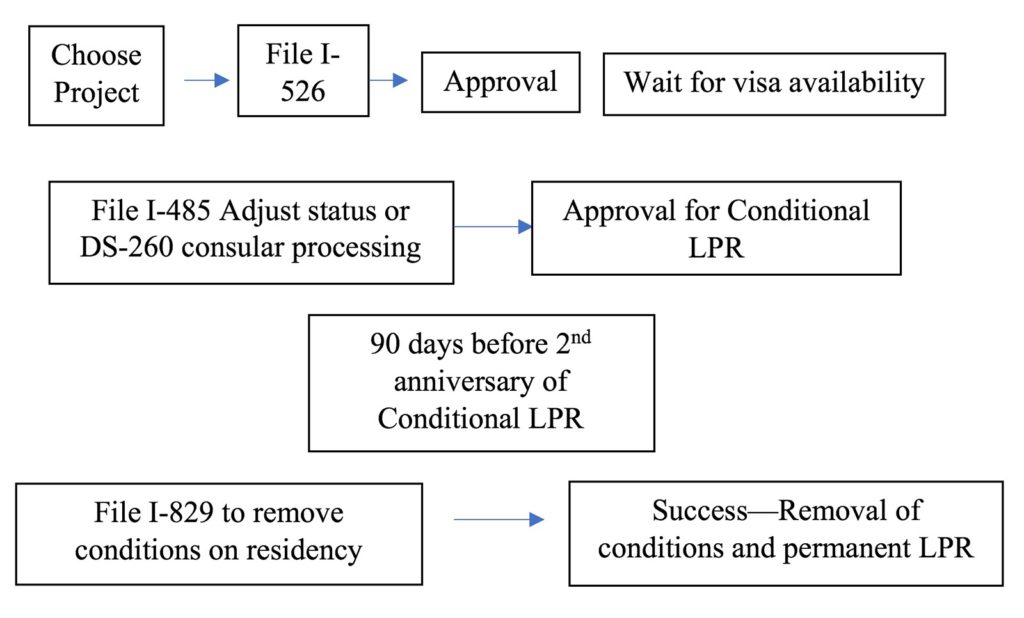

A basic description for the EB-5 program is a visa with a two-year investment that creates ten jobs. However, as a practical matter, the process takes much longer with the typical time frame in the best-case scenario being in the range of 6-8 years. But be aware that the visa wait times can be much longer. A word of caution is also in order that timelines are only estimates that may change given future circumstances.

The first step in preparing to file for an EB-5 is for the investor to find a project and ensure it is appropriate. Once the project is picked, the first filing with USCIS is the Form I-526, Immigrant Petition by Alien Entrepreneur. However, there will be time needed to prepare this form such as a business plan, designation of the TEA if applicable, documenting source of funds and making the investment. Once filed, the approval time for these petitions has generally increased over the last couple of years with current expected times ranging up to 2 years.

Once the petition is approved, then the investor must wait until a visa becomes available by reference to the visa bulletin for adjustment of status or consular processing. The date to use in applying the visa bulletin is the “priority date” when the I-526 was properly filed. However, care must be taken in estimating visa wait times from the dates in the bulletin. This is due to a number of factors relating to backlogs and often known at visa retrogression where visa availability moves at an irregular pace.

For much of the world the visa wait time is “current” in the bulletin for EB-5, except for China and Vietnam. However, the Department of State has recently provided potential wait times for a visa if a Form I-526 was filed on October 30, 2018 as follows: China, 14 years; Vietnam, 7.2 years; India, 5.7 years; South Korea, 2.2 years; China-Taiwan, 1.7 years; Brazil, 1.5 years.

Once wait times are current and the Form I-526 petition is approved, the investor will either adjust status by filing the Form I-485, Application to Register Permanent Residence or Adjust Status (with USCIS to adjust status to a conditional permanent resident within the U.S.) or file for consular processing with the Form DS-260, Application for Immigrant Visa and Alien Registration (with the U.S. Department of State to seek admission through consular processing to enter from outside of the U.S.). In this step, the investor will be examined to determine admissibility as in any other visa. This approval process is relatively fast with times ranging up to about 1 year.

Upon the approval of adjustment of status or upon admission into the United States with an immigrant visa from consular processing, the investor will be granted conditional lawful permanent residence (LPR or green card) for a 2-year period.

The last step is filing the Form I-829, Petition by Entrepreneur to Remove Conditions on Permanent Resident Status. This petition is to be submitted to USCIS within 90 days of the 2-year anniversary of the granting of permanent residence. The USCIS will review the petition to determine if all the requirements of the EB-5 program have been met. This process may take 1-3 years after the 2-year requirement for the conditional residency.

Source of Fund Counseling and Project Due Diligence and Selection

Source of Fund Counseling

One of the major requirements for the EB-5 is that there is a demonstrated lawful source of funds. The minimum investment of $500,000 or $1 M must come from assets that were obtained, directly or indirectly, by lawful means. There is not any particular form to use but the USCIS must be convinced by the submitted documentation. Two analysis need to be made, that the source of the funds was by lawful means and that the transfer of funds or pathway into the investment was lawful.

The narrative for the source by lawful funds should be easy for the USCIS to follow. All sources of funding are to be explained. The USCIS will act like a forensic accountant and tear apart all assertions and documentation to be sure the funds are legitimate. It is important that there are no gaps in the narrative.

Third party documentation is the best to confirm the transactions. If not available, then signed affidavits may be used with other personal information.

As with all financial transactions in general, tax returns are important. Provide all related personal and business tax returns, including inheritance and gift returns, for the last 5 years. If there are no tax returns, then documentation should be presented explaining why tax returns are not required. If the tax returns do not show the appropriate high-income years, best practices would include submission of other tax returns or information that explains the investor’s wealth.

USCIS lists the following requirements as applicable:

- Foreign business registration records;

- Evidence identifying any other source(s) of capital; or

- Certified copies of any judgments or evidence of all pending governmental civil or criminal actions, governmental administrative proceedings, and any private civil actions.

Although the USCIS lists seems to be manageable, many more documents to fully show the legitimate source of funds are required.

All sources of the capital must be demonstrated. According to the USCIS, evidence of other sources of capital may include:

- Corporate, partnership, or other business entity annual reports;

- Audited financial statements;

- Evidence of any loan or mortgage agreement, promissory note, security agreement, or other evidence of borrowing which is secured by the immigrant investor’s own assets, other than those of the new commercial enterprise, and for which the immigrant investor is personally and primarily liable;

- Evidence of income such as earnings statements or official correspondence from current or prior employers stating when the immigrant investor worked for the company and how much income the immigrant investor received during employment;

- Gift instrument(s) documenting gifts to the immigrant investor;

- Evidence, other than tax returns, [44] of payment of individual income tax, such as an individual income tax report or payment certificate, on the following:

- Wages and salaries;

- Income from labor and service or business activities;

- Income or royalties from published books, articles, photographs, or other sources;

- Royalties or income from patents or special rights;

- Interest, dividends, and bonuses;

- Rental income;

- Income from property transfers;

- Any incidental income or other taxable income determined by the relevant financial department;

- Evidence of property ownership, including property purchase or sale documentation; or

- Evidence identifying any other source of capital.

If the source of funds is a gift or a loan, then the inquiry will also go to see that the donor’s or lender’s sources of funds are lawful. The purpose of the gift or loan can be to allow the investment in the EB-5 project. However, the EB-5 project cannot be the collateral and the collateral must also be shown to be derived from lawful means.

Inheritance can also be used to fund the EB-5 program. To show that the inheritance is legitimate, examples of documents to be submitted include the tax returns of the estate, death certificate and documentation to show that the funds in the inheritance were obtained by lawful means.

The pathway of the funds into the EB-5 project must also be shown to be lawful. This can be done by appropriate wire transfer etc. It can be complicated in countries that have restrictions on the timing or amount of money that can be removed. Evidence of the investment include bank statements showing deposits, purchase or transfer of assets to be used in the business and loan documentation obtained by the investor for placing in the business.

Project Due Diligence and Selection

The beginning of an EB-5 program is the selection of an appropriate project. From the investors point of view, securing the lawful permanent residence for immigration is the main point for using this program. The investment must be appropriate and designed to produce at least 10 new permanent full-time jobs. The other important investor consideration is the return of investment at the end of the immigration process.

As with other typical investments, there are no guarantees for success. By its terms, the EB-5 program requires that the investor’s funds be placed “at-risk.” However, project due diligence requires the selection of the project be made that minimizes the risk to the investor and maximizes the chances for success, both for immigration purposes and the return of investment.

If there is a general rule for due diligence, it is best if the results of due diligence are based on conservative estimates. Building in reasonable cushions is a conservative measure. Estimates are conservative if revenue projections are on the low side, but expense projections are not.

Due diligence also continues during the project to ensure that the project is appropriately moving ahead with proper expenditures. The extent of the due diligence is dependent on the project’s scope.

In a direct EB-5 project, the investor may be the owner of a new closely held business. In this case, the due diligence will concentrate on the viability of the business and meeting the immigration requirements. This includes a credible business plan considering proper amounts and sources of capital, business structure, management, scope of business, competition, compliance with business laws including HR and employment laws and creation of the required number of new jobs.

In the case of a pooled investment where the investor may not have been involved initially, the investor will want to conduct appropriate due diligence into the newly created commercial entity. Likewise, in the case where an existing business is purchased or perhaps part of a franchise, then the investor should perform due diligence so that the investor is confident in the purchase.

Some general due diligence considerations are as follows, especially for the pooled investor:

- Are EB-5 requirements met and creation of jobs likely

- Likelihood of project success

- Return of investment

- Use of funds and consistency with the business plan

- Details for all fund disbursements with proper controls

- All business documents consistent with each other

- Legal and licensing requirements met

- Business plan meets Matter of Ho requirements

- Exit strategy for pooled investors including job credit allocation

- Redeployment considerations

- TEA designation proper

- Contingency plans for possible shortcomings

- Appropriate background for money managers and other professionals

By way of comparison, the Regional Center model involves multiple parties, investors and entities with a project organized by the Regional Center. In this case, best practices provide that due diligence be required into both the project and the Regional Center itself.

Another important aspect of EB-5 investment is securities law. Securities law has implications when investments are sold to others and should be evaluated by a securities attorney.

Investors typically rely on professionals for advice. These may include professionals such as:

- Immigration attorney

- Securities attorney

- Business attorney

- Accountants

- Economist

- Business plan writer

- Transactional attorney

- Real estate attorney

- Foreign agents

The immigration attorney’s role is typically to serve as gatekeeper and see that the immigration requirements are met. While other professionals are employed, it is the immigration attorney who is often in the best position to guide the due diligence inquiry and see the entire picture to provide advice. However. the attorney must also be careful not to overstep the attorney’s role in giving financial and investment advice.

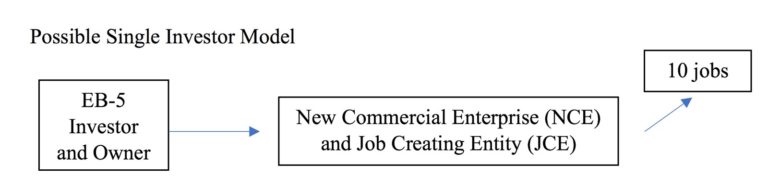

Direct Investment Case vs. a Pooled Investment Case

The direct EB-5 model lends itself to smaller businesses where the single investor wishes to be involved in the day to day operations. The investor places equity capital into the business. In this model, only direct job creation is allowed.

Possible Single Investor Model

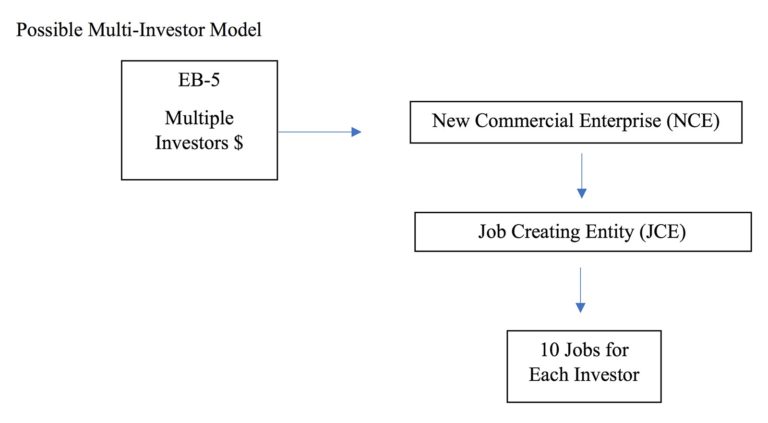

In the pooled direct EB-5, more than one investor will invest in the business. A limiting factor is that there must be 10 new jobs for each investor. The new commercial entity may create the jobs or may be the owner of wholly owned subsidiaries that create the jobs. The EB-5 money may be one of multiple funding sources.

Possible Multi-Investor Model

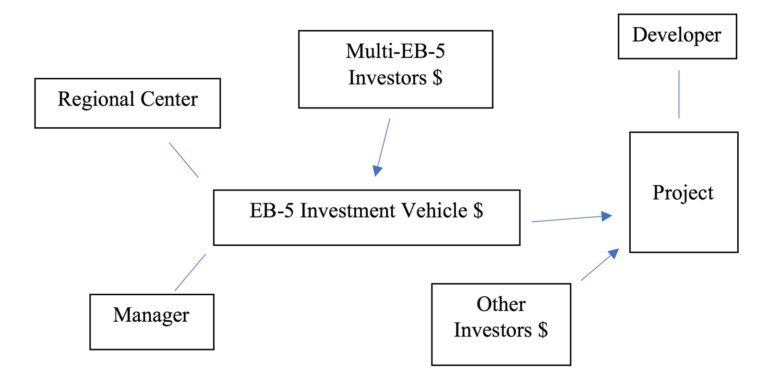

A word about the alternative to the direct EB-5 program known as the Regional Center model that is the most common EB-5 model. It works something like the pooled direct EB-5 except a Regional Center is involved in the organization and administration of the project. The investors make an equity investment with many other EB-5 investors into a new commercial enterprise (NCE) associated with the Regional Center. Unlike the direct investment model, it allows indirect job creation by economic modeling in addition to direct job creation.

The Regional Center model lends itself to those investors who want to take a more passive role, as one of many investors in a project that is run by others. Regional Centers are often used for placing foreign investment into construction projects. On the other hand, direct EB-5 projects lend themselves more to operational retail and wholesale enterprises that create direct jobs such as franchises, hotels, restaurants and supermarkets, manufacturing jobs, service providers and the like.

The Regional Centers are registered with the USCIS. A regional center may have multiple projects and can aggregate large numbers of investors and dollars. The developer of a particular project may set up a “full-service” Regional Center for a particular project or a developer may use an already existing center in a “rent-a-center” model.

The I-526 Petition: Nuts and Bolts

In basic respects, once the project is selected, the immigration process for EB-5 follows the same continuum as other immigration paths to lawful permanent residence. An initial petition is filed, in this case the Form I-526, Immigrant Petition by Alien Entrepreneur. Once that petition is approved, then the investor must wait until a visa is available. When a visa is available, an application is filed for either adjustment of status in the U.S. or consular processing if out of the U.S. After approval at this step and presence in the U.S., the investor becomes a conditional lawful permanent resident (LPR or green card). If the EB-5 requirements have been met after two years, then an application can be approved permanent residency (including the spouse and children).

Once the project is selected, then the investor is set to place the EB-5 project in motion. It is important that all issues be assessed prior to the time that the investment is made. Otherwise, the investor may end up in the middle of a process with a major investment where no successful immigration can take place.

It is necessary to determine if the foreign investor is admissible under the ordinary rules that govern immigration. While not assessed at the initial I-526 stage, these grounds will be assessed later at adjustment of status or consular processing to obtain the green card.

One of the important benefits of the EB-5 program is that the investor may include the spouse and children. Children for this purpose are unmarried and under the age of 21 years old. If it is an important consideration for the children of the investor to become residents, then the process should evaluate whether the child will “age-out” prior to a visa becoming available. Given the long wait times in countries like China and others, it is possible that the children may “age out” before a visa is available. While the Child Status Protection Act (CSPA) may provide some relief by freezing the age of the child during the pendency of the I-526, this must be evaluated to determine if the EB-5 program will truly meet the investors desires.

In addition to the Form I-526, other forms include the Form G-28, Notice of Entry of Appearance as Attorney or Accredited Representative. There is also the optional G-1145, E-Notification of Application/Petition Acceptance. The filing fee is currently $3675. Best practices dictate that the package should include an attorney cover letter with exhibits and an exhibit list.

The approval of the I-526 confers no immigration benefit. It provides the priority date to determine when a visa will be available. Nevertheless, USCIS expects the I-526 to provide how the requirements of the EB-5 project will be met. The burden of proof is by the preponderance of the evidence.

In order to satisfy the petitioners burden with the I-526, many supporting documents are required. It should also be noted that approval of the I-526 is now taking up to 2 years. If the investor is out of the U.S., consideration should be given to hiring a day-to day manager to get the business up and running. Otherwise, investments such as a lease sit empty, job creation is not being generated and business opportunities may be missed. In addition, an idle business works against approval of the I-526.

The first order of business is the petitioner’s status and relationships. Relevant documents include birth certificates, marriage certificates and proper documentation of lawful status if in the U.S.

If the investor has applied to come to the U.S. in the past, those documents and applications should be reviewed. Inconsistencies should be avoided or explained including dates of U.S. visits, dates of physical addresses and employment history.

The legitimacy of the new commercial enterprise (NCE) will need to be supported. Organizational documents serve this purpose such as articles of incorporation and other corporate documents including by-laws or operating agreements. Proper business permits and certificates of authority should be included as well as tax information such as FEIN.

Other documents to show the operation of the business also should be included. These include stock purchase agreements, payroll records, leases or deeds for the premises, marketing material, bank accounts and other financial records. Without some business activity, the petition may be denied for lacking assurance that the funds will be properly used.

Documents evidencing the investment should be included. The documents should show the purchase of ownership interests through shares of stock and other shareholder documents, membership agreements and the like. In the case of a sole proprietorship, the funds must be at a minimum placed in a business account. Records of deposit, purchase and transfer of assets and loans to the investor to place into the project may be applicable. The goal here is to demonstrate the investor’s ownership and proper involvement.

If the investment is made in a Targeted Employment Area (TEA), the documentation to show the TEA certification should be included. The requirements for the TEA are often a state function and may require signoffs of local officials. In addition, an economic analysis is sometimes required.

Management involvement of the investor is required to be shown. The investor must submit certain documents including the position title and duties with evidence of an officer position, board of directors or partnership responsibilities.

An important part of the I-526 is a compliant business plan. The plan must be comprehensive, credible and set forth a description of the business, products and/or services and its objectives. It should demonstrate that the requisite number of jobs will be created. The requirements are set forth in the Matter of Ho, 22 I&N Dec. 206, 213 (Assoc. Comm. 1998). In the USCIS Policy Manual, some of the requirements for the business plan are set forth as follows:

- market analysis

- required permits and licenses obtained.

- manufacturing or production process, the materials required, and the supply sources.

- contracts executed for the supply of materials or the distribution of products.

- marketing strategy of the business

- set forth the business’s organizational structure and its personnel’s experience.

- the business’s staffing requirements

- contain a timetable for hiring

- job descriptions for all positions

- sales, cost, and income projections

Finally, the legitimate source of funds and the legitimate pathway of investment will need to be shown.

Immigrant Visa Card Processing and Adjustment of Status Application

Once wait times are current and the Form I-526 petition is approved, the investor will file either the file Form I-485, Application to Register Permanent Residence or Adjust Status (with USCIS to adjust status to a conditional permanent resident within the United States) or the Form DS-260, Application for Immigrant Visa and Alien Registration (with the U.S. Department of State to seek admission through consular processing out of the U.S.). In this step, the investor will be examined to whether grounds of inadmissibility attach. In some cases, even if the potential immigrant is inadmissible, waivers may be available. Common grounds of inadmissibility include:

- Criminal

- Misrepresentation & False Claim to Citizenship

- 3- & 10-Year Unlawful Presence Bars

- “Permanent Bar”

- Health

- Alien Smuggling

- Prior Deport Order

- Public Charge

- Security

Upon the approval of the adjustment of status or upon admission into the United States with an immigrant visa from consular processing, the investor will be granted conditional permanent residence for a 2-year period.

If the investor is in the U.S., approval of the I-485 will result in the green card being sent to the investor. If the investor is out of the U.S and consular processing is successful, the investor will be granted an immigrant visa and be given a sealed packet. Upon presentment at the port-of- entry, the U.S. Customs and Border Patrol will grant or deny entry. If successful on entering the U.S., the investor will be sent the green card.

It is during this two-year period that the business plan will be fully implemented. The investor (or the immigration attorney) should periodically review the business activity in light of successful EB-5 project requirements including compliance with such as proper hiring of any noncitizens. In addition, USCIS conducts field audits and the business should be prepared to properly respond should a USCIS official appear at the door.

I-829 Application Process

At the time of filing the initial I-526, planning should already be underway in how to obtain final approval of the Form I-829, Petition by Entrepreneur to Remove Conditions on Permanent Resident Status. Document collection should begin and continue throughout the conditional residence. The purpose the I-829 petition is for USCIS to determine if the requirements for the EB-5 program have been met. The I-829 petition is to be filed within the preceding 90 days before the second anniversary of obtaining the conditional residency.

USCIS will not generally re-examine determinations made with the initial filing such as whether the Matter of Ho business plan is compliant unless there has been a material change, fraud, misrepresentation or some other legal deficiency. Particularly important in the I-829 reviews is the flow of funds into the project, sustainment of the “at risk” investment and that the investment was used for job creation. While money can be lost in the investment, it cannot go back to the investor during the “sustainment” period.

The investment must be sustained ‘at risk” throughout the “sustainment” period. The notion of the sustainment period centers around the 2-year conditional residency but there are inconsistent provisions relating the length of the sustainment period for “at risk” funds. The question is whether funds can be returned at the end of the two-year conditional residency period after the I-829 is filed or if the capital return must wait until the I-829 is actual approved. Recent guidance from the USCIS indicates that the “at risk” investment need not exceed the end of the 2nd year of the conditional residency after the I-829 is filed.

Documentation may include such things as internal communications to show the role of the investor and that the project is operating within the business plan. Financial documents are also important such as bank statements and other financials. It has been reported that USCIS is also asking for records for the additional two years while the I-526 was pending.

Showing job creation is document heavy. Common records include payroll records, W-2s and I-9s to confirm lawful status to work. If the I-9s are not filled out properly, the business may be referred for an examination.

If the jobs are to be created after the conditional residence, then they may still be counted if they will be created within a reasonable period of time. A reasonable period of time is usually one year unless there are extraordinary circumstances. Things that may delay job creation could include revenues not up to expectations or litigation delaying the project.

Material change in the business plan is not defined. USCIS has indicated that a material change before approval of the I-526 could require a new filing. In this regard, it is important that the investor come to the U.S. as soon as possible to obtain the conditional green card after the visa is approved.

A material change does not necessarily require a new filing if it takes place after the conditional residency is obtained. Rather, the ISCIS may focus is on the requirements during the conditional residency such as sustaining the “at risk” investment and creation of the required new jobs.

Citizenship Application Process

The path to citizenship requires the person applying for naturalization to be a lawful permanent resident for 5 years. The conditional residence and subsequent LPR status provided by the EB-5 program counts toward that 5 years. In addition, any LPR child with the parent under the age 18 at the time that the parent naturalized also becomes a citizen by a process know as derivation of citizenship.

There are 9 basic requirements for naturalizing as a U.S. citizen. While exceptions exist due to such things as being married to a U.S. citizen, age or service in the military, the nine basic requirements are:

- Be a lawful permanent resident for at least 5 years;

- Be at least 18 years old;

- Lived for at least 3 months in the state or USCIS district;

- Continuous residence in the United States for at least 5 years;

- Physically present in the United States for at least 30 months out of the 5 years;

- Be able to read, write, and speak basic English.

- Have a basic understanding of U.S. history and government (civics).

- Be a person of good moral character.

- Demonstrate an attachment to the principles and ideals of the U.S. Constitution.

Exit Options and Capital Return

Direct EB-5 investments tend to be smaller businesses that are investor managed. At the end of the sustainment period, decisions for the business can be made as with any other business. These can include sale of the business, obtaining a loan to refinance or maintaining the investment as an ongoing enterprise.

There are also some murkier areas.

If a project fails but the jobs were previously created, USCIS indicates that the legitimate jobs that were created but lost will count toward job creation. It would seem reasonable to conclude that a loss of investment would be the ultimate “at-risk” option and the requirement for the sustainment of the investment would be met.

In a direct EB-5 pooled investment, it is possible that different investors could have I-829 approvals at different times due to differing investment times. In that case, an earlier investor may not wish to wait for a return of investment for the later investors. Best practices should require that the formation documents address the exit strategy and job allocations in pooled investments.

If the investment is returned to the investor from the NCE prior to the completion of the sustainment period, the project will not meet immigration requirements. Given the length of time to acquire a visa especially for investors from China, Vietnam and other similarly situated countries with long visa wait times, this has given rise to the “redeployment” of funds rather than return of funds. This has become important especially in Regional Center projects. The USCIS provides that redeployment into a new project is permissible to prevent return of the investment to the investor if the redeployment is “at risk” for the investor, made within a commercially reasonable time and within the scope of the ongoing business of the initial new commercial enterprise. Best practices require that the initial formation documents should address redeployment.